The South African government has been driving its nuclear power plans forward over the last few months. There have long been concerns, as recently expressed by President Zuma’s Minister of Finance, Malusi Gigaba, that South Africa cannot afford nuclear power. There has been speculation that the World Bank might be a source of funds to allow the project to go ahead. However, there are several reasons that make this is extremely unlikely, to say the least.

The World Bank has funded nuclear power in the past. Once!

Nuclear plants are very expensive up front, and borrowing money to build them generates large interest repayments. In the early years of operation, almost all the profit from the plant is spent on paying this interest. As the years go by, the capital is gradually paid off, and once that is done the nuclear plant can become profitable. Towards the end of its life, after the debt is fully repaid, it generates very large profits. Assuming nothing goes wrong, that is…

From World Bank Board meeting notes

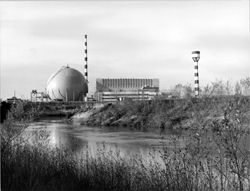

In 1959, the World Bank loaned $40 million for the construction of a 150MW nuclear power plant in Italy on the Garigliano river. This was World Bank loan number 0235, at an agreed interest rate of 6%, to be fully repaid by August 1979. The Guarantor of the loan was the Republic of Italy.

In 1959, the World Bank loaned $40 million for the construction of a 150MW nuclear power plant in Italy on the Garigliano river. This was World Bank loan number 0235, at an agreed interest rate of 6%, to be fully repaid by August 1979. The Guarantor of the loan was the Republic of Italy.

It was a uranium fuelled boiling water reactor built by General Electric and started operation in 1964. After just 12 years of operation, it was shut down in in 1978 due to damage to one of the steam generators. Four years later it was declared to be permanently out of service.

Financially speaking, it was a disaster…

The scheduled total repayment of capital during the last two years of the loan, 1978 and 1979, was set to be $829 200. This amount, plus the interest due, had to be paid while the plant was not generating electricity or revenue.

The scheduled total repayment of capital during the last two years of the loan, 1978 and 1979, was set to be $829 200. This amount, plus the interest due, had to be paid while the plant was not generating electricity or revenue.

It seems the plant never hit its ‘sweet spot’, where the loan is repaid and the plant finally generates profit for its owners. There is not much to be found online about the plant, so this could not be confirmed from annual financial statements. It is also not clear if the Italian taxpayer ended paying off the loan as per the Guarantor agreement.

Fool me once …

Whatever the exact financial outcome, it clearly was not something the World Bank was in a hurry to try again.

Whatever the exact financial outcome, it clearly was not something the World Bank was in a hurry to try again.

Since then it has not funded any nuclear power projects, and has repeatedly been quoted as saying “The World Bank does not engage in providing support for nuclear power” and more simply, “We don’t do nuclear energy”.

Bank loans?

Some may hope that capital for a nuclear plant could be raised from banks. But banks evaluate risk and return dispassionately, and are influenced by rating agencies such as Moody’s.

Moody’s Investor Services wrote of nuclear plants in 2008, before even the Fukushima disaster: “The technology is very costly and complex, and the 10- to 15-year duration of these construction projects can expose a utility to material changes in the political, regulatory, economic and commodity price environments, as well as to new alternatives to nuclear generation“.

Insurance?

There is a good reason that all household insurance policies exclude damage or loss of value from a nuclear or radioactive incident. The risk of properties in a large area losing most or all of their value would be far too vast a loss for an insurance company to cover.

There is a good reason that all household insurance policies exclude damage or loss of value from a nuclear or radioactive incident. The risk of properties in a large area losing most or all of their value would be far too vast a loss for an insurance company to cover.

Nuclear plant operators take out a limited insurance, with a low cap, somewhere around R3 billion in South Africa. That may sound like a lot, but its just a fraction of the total property values in Melkbosstrand alone (a suburb near Koeberg). And there would be many other damages for which the operator would be liable.

Why will no-one insure a single nuclear plant?

Nuclear power is inherently different to ‘normal’ insurance. Its easy to calculate the risk for a car owner. There is plenty of data to show the likelihood of an accident, and the cost of repairs. The crucial fact is that a car insurance policy will probably have more than one claim over the life of the policy. This means the premiums can be worked out to cover the costs, plus a profit for the insurance company.

For a nuclear plant, the chance of a serious accident is on average relatively very low. So low, that a specific plant is quite likely go through its life without blowing up. However, if it does, the claimed amount would be astronomical. Therefore to make the insurance policy of a single plant cover the possible costs and still make a profit, the insurance company would have to charge astronomically high premiums. A few thousand years of risk needs to be covered by sixty years of premiums.

That is why nuclear insurance is done though ‘pools’ whereby risk from many nuclear plants is rolled into one by a ‘super-insurer’, with a strict capped upper limit on the amount they would need to pay out.

This capped liability is set by law. In South Africa that is specified by the NNR Act of 1999, section 30 (2). This is in effect a government subsidy of nuclear power, without which the insurance premiums would be so high that it would be economically impossible to build a nuclear plant.

Vendor financing?

Vendor financing is where a vendor funds the project off its own balance sheet. But due to the high cost involved, a minimum of R350 billion by the most conservative estimates, no vendor could fund the full amount, especially given that mega projects usually run to at least twice over budget.

The vendor could on the other hand facilitate funding from another source… but then we are in effect back to the previous two options. What is more, the Treasury will likely be required to guarantee the loan, which they refused back in 2008.

In conclusion…

No World Bank loan, and no bank loan. The only hope for those driving the nuclear power agenda seems to be some complex vendor assisted finance, signed off by a captured Treasury.

References:

http://pubdocs.worldbank.org/en/674991400161335640/wbg-archives-1854245.pdf

https://mg.co.za/article/2014-09-18-can-sa-afford-to-go-nuclear

Reblogged this on nuclear-news.

Pingback: The week in climate/nuclear news | Nuclear Australia

Pingback: The week that was, in nuclear news « nuclear-news